3 things I'm thinking about this week...

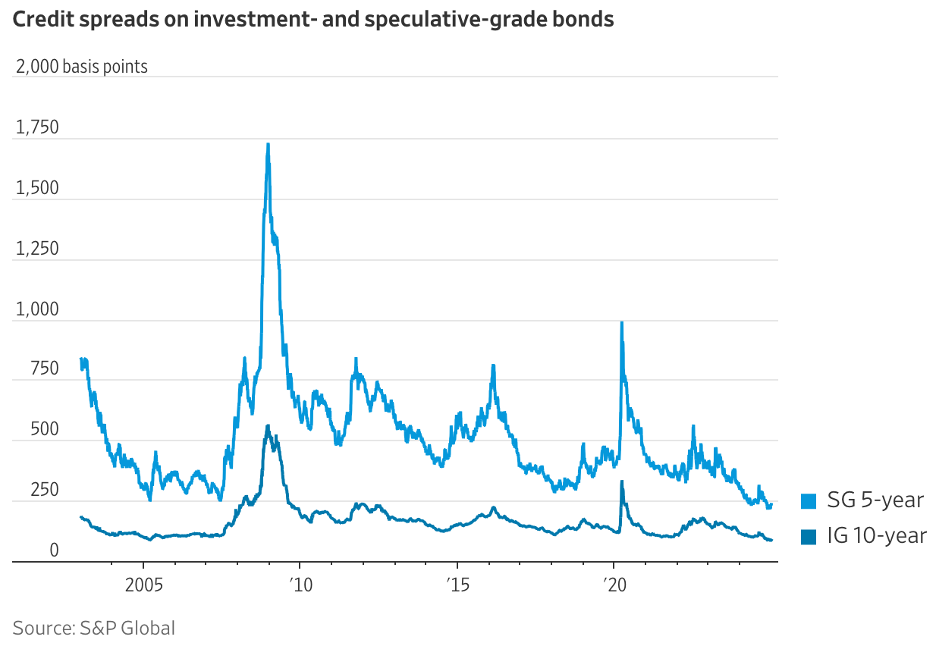

1 – Irrational Exuberance? Credit spreads are tightening…meaning corporate borrowers are paying a smaller premium over the “risk-free” Treasury rate. The good news…people are feeling good about the economy when spreads tighten. The bad news…people are feeling good about the economy…and overpaying for lower quality credit which could come back and bite them. And some companies are overstretching their balance sheets. In investing, over-exuberance at purchase tends to lead to less going forward. A short overview here.

2 Pre-Mortems: Part II. – I first wrote about pre-mortems 4 years ago, saying that they “help release “trapped” or unconscious knowledge and concerns that people have about a project that may not have been voiced.” Useful in investment analysis.

This recent article details a pre-mortem devotee…Panera bread founder Ron Shaich. He asks himself “what can I do in the next three to five years that I will respect looking back from my deathbed?” It helps him in 3 ways...reduces remorse for opportunities missed, lets him live with intention and helps him adapt to different life stages…as he aged, he moved from “joining corporate boards” to “determining his successor at Panera.”

3 – Deepfake Dangers. The world revolves around identification. Like good cyber credentials. And our unique facial appearance and manner. Now under threat from misuse of AI. Machine learning can create deepfake videos and voice clones, in real time. What’s at stake here is the confidence that you are truly speaking with a family member. This article suggests “being politely paranoid” when you receive an urgent request for help. The FBI recommends creating “a secret word or phrase” to help confirm your identity with your family and those close to you.

…and one more thing

The eternal (and futile) quest to predict short-term markets continues…