3 things I'm thinking about this week...

It’s normal to see a sharp, temporary market reaction to this type of news. Emphasis on temporary. You need to be ready for a 10-15% dip any year, and a bigger one every 5 years or so, again both temporary. The S&P 500 Index fell 12% from “Liberation Day” April 2 to its near-term low 6 days later. When a 90-day pause on tariffs sent markets up significantly.

The question of what's to come in the weeks and even months ahead falls into crystal ball territory. But the question of how to plan your financial future, and invest based on your goals, hasn't budged an inch. Jason Zweig points this out in his Intelligent Investor article in The Wall Street Journal.

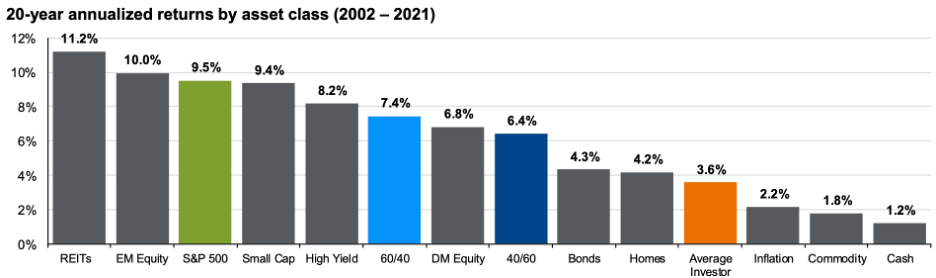

2 - Try Blue, it (should be) the New Orange. Adapted from a line in my favorite Pixar movie, WALL-E. Average is what many people aim for in life. Just trying to fit in. And that’s OK in some areas. But acting like an “average” investor is, frankly, a mistake. Look at the difference between the 60/40 (stocks/bonds mix) Index in Blue…and the average investor in Orange:

Source: JP Morgan

The difference comes from (mis) behavior, and it’s big. The 60/40 investor had double the annualized return of the average investor. Or $2.3 million MORE on a $1 million portfolio over 20 years. Average money behavior is about as good for our financial longevity as an uncontrolled diet is for our physical longevity.

3 - Howard Marks on Tariff Turmoil. Went through his latest Memo. 3 things he’s dead-right on: Understanding that second- and third-order consequences to U.S. trade policy can be damaging and aren’t being thought through. Comparative advantage makes sense - countries should produce the highest value goods they are capable of and buy the rest of what they need from others. And…times like these are when bargains pop up for those who are looking.

...and one more thing

Saw this in San Clemente...really?