Who's Cooler?

From high school to wherever you are at today, there’s two groups of people you'll run into: optimists and pessimists. Optimists can sound naive and overly trusting, trumpeting a bright future. Everything will go right, don't worry so much.

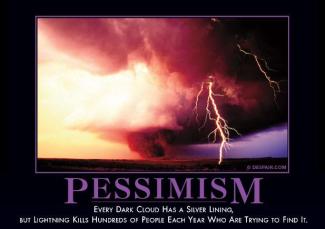

Pessimists are the “cool kids” hanging out at the back of the school pointing out the flaws of the world. Don't believe everything you hear. Gloom and doom, if they're not here yet, are certainly on their way.

Morgan Housel’s excellent book The Psychology of Money highlights these differences from an investment perspective. Pessimism "sells" in investing because sounds like someone who is trying to help you. It grabs more mental attention because we are hard-wired to care more about investment losses than we are about gains. Compounding all of this, most media tends to focus on what is or could go wrong, so we end up spend a lot of time reading and thinking about it.

Yet, the longer-term story of successful investing is that of rational optimism. Ultimately your investments are typically valued in the marketplace on how well they grow cash flow and business value over time. Not in the next week or two, but over a multi-year horizon. And like a lot of things in investing, the more people that pile into an idea, the less attractive the returns become. Many people sell in downturns, keep money in cash, and never start investing because of their daily pessimist training. The rational optimists you don’t read about (boring success stories being less interesting) are invested today and stay invested.

Something to think about.